Investor Update June 2025 – Traditional financial markets are warming up to crypto, offering trading opportunities

Executive Summary

This year has been exciting for crypto market participants. The following are the core themes driving the market.

Bitcoin Treasury Companies & Regulatory progress

- Public companies added +74,983 BTC YTD, nearly 2x the new supply (+40,369 BTC)

- Genius Act passed in Senate (68–30): mandates audits and AML compliance for stablecoin issuers

- SEC has dropped multiple enforcement actions

- Clarity Act gaining momentum—aims to protect DeFi developers from money

transmitter classification

Circle IPO, Strategy (ex-MicroStrategy), and Coinbase

- Circle’s IPO surged 80% on day one

- Valuation currently sits at 233x earnings

- Coinbase, Circle’s key partner, receives >50% of Circle’s revenue ($900M of $1.7B in 2024), but its stock has been lagging Circle’s IPO success, until recently

- Strategy’s (MSTR) issuing of equity/debt to buy BTC may be losing effectiveness, the flywheel is slowing down, as evidenced by recent price action

- Strategy still trading at $ 107B Market cap with revenues of only $ 450-500M vs. COIN market cap at $ 90B with revenues of $ 6.3B & positive FCF

- Coinbase’s role may be underappreciated – a potential relative value trade

Market Opportunities

- Short-term dislocations and volatility in crypto-linked equities present discretionary arbitrage & yield generation trades (e.g. Vol arbitrage)

- Asymmetric return profiles at the equity level, amid stable crypto conditions

- Mispricings and elevated volatility oer strategic entry points for active investors

Institutional Adoption and Corporate Demand

2025 has seen a marked increase in institutional engagement with cryptocurrencies. Notably, publicly listed companies have accumulated a net +74,983 BTC in their treasuries YTD—almost double the new supply of +40,369 BTC—creating a supply deficit on exchanges and underpinning Bitcoin’s price strength.

Circle’s June IPO surged 80% on day one, reflecting Wall Street’s growing conviction in stablecoins, with USDC now commanding a $61 billion market cap alongside Tether’s $155 billion. We’ll dig into Circle’s valuation further down.

Regulatory Clarity and Stablecoin Oversight

Regulators have moved to provide clarity around stablecoins and broader digital-asset governance. The U.S. Senate’s passage of the Genius Act (68–30) establishes federal oversight of stablecoin issuers—including audited reserves and anti-money-laundering rules—paving the way for consumer protections and industry legitimacy. In parallel, several SEC enforcement actions have been dropped, and momentum is building behind the Clarity Act to shield DeFi developers from money-transmitter classification, easing legal uncertainty.

The MicroStrategy “Flywheel”

MicroStrategy (or newly “Strategy”) is the most prominent “Bitcoin Treasury” company, issuing debt or equity instruments to buy bitcoin. Despite criticism, the stock increased significantly over the past year. Of course, this is by design because with each debt (or equity related) issuance, MSTR buys Bitcoin, rewarding earlier investors with more Bitcoins/Share ratio. So, if you assume Bitcoin is stable (or goes up), buying the stock (seems) makes sense because you can piggyback on the next investor who subsidizes the Bitcoin per Share ratio in your favor. The main challenge

with this trade is obvious though: once the flywheel stops, it could get ugly.

We would argue the flywheel effect is now slowly fading because…

- …despite continuing issuance and public marketing of its strategy, the stock price has not been able to regain its ATM from 2024, and is showing signs of slowing returns

- …the same strategy is not working for other publicly listed companies that followed suit, such as MARA, DJT and GME, all of which are down YTD (see below chart) indicating fading interest in the strategy

- …hedge funds were fueling the trade in its early days through convertible arbitrage strategies, but the trade has become crowded and likely approaching internal risk limits

Circle IPO

Circle’s valuation should fundamentally be a function of interest payments on the treasury reserves. Its current valuation is a hefty 233x Earnings!

These valuations seem absurd, unless you assume the following four things remain true at the same time:

- Immense stablecoin growth, …

- … of which CRCL continue to take the majority share

- Short-term rates remain stable (or increase)

- Regulation continues to prohibit holders of stablecoins to receive interest

In the absence of any of those assumptions, the valuation is going to be challenging.

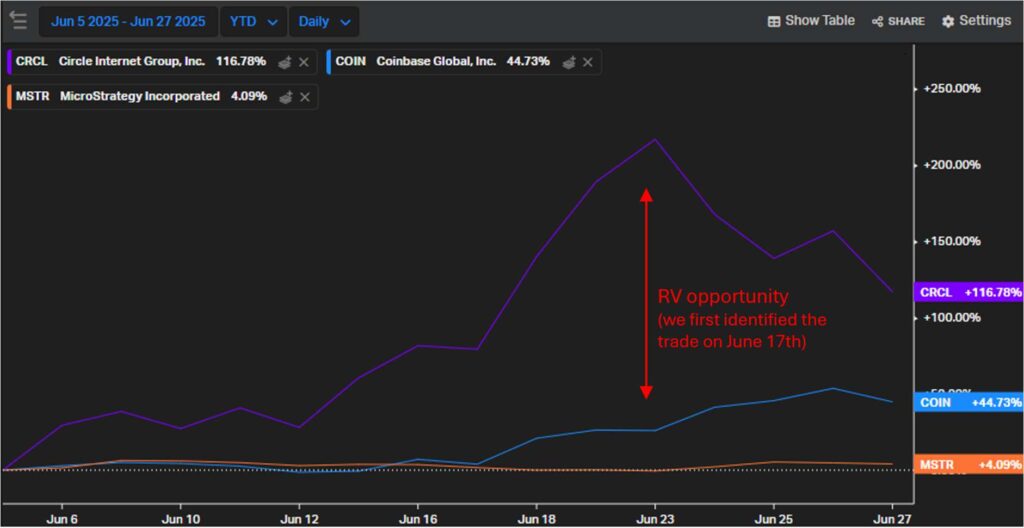

Lastly, there is Coinbase, who has a revenue share agreement with Circle (Coinbase was one of the early backers of Circle at its inception). Coinbase receives more than 50% of Circles’ revenues! In 2024, Circle earned $1.7B revenue while paying more than $900M to Coinbase for distribution. However, the appreciation in Circle’s stock price after the IPO was barely reflected in Coinbase stock – so either

A) the Circle stock is currently overvalued or

B) the market hasn’t appreciated Coinbase’s role

It seems like there is a potential RV trade, despite the recent price action which has partially closed the gap.

Opportunities

With these mispricings, and price swings over short periods of time, we see significant

opportunities in discretionary arbitrage strategies. Specifically, within crypto-linked equities, we have identified attractive asymmetric trades that allow investors to take advantage of heightened implied volatilities against the backdrop of a generally stable crypto-native ecosystem.

If you would like to discuss any of our current trade ideas, please reach out to us.