Investor Update March 2025 – Market downturn brings opportunities

After a few months of hiatus, we’re excited to resume our market commentary following our rebranding to Matrixport Asset Management AG.

Since the 2024 U.S. election, Bitcoin rallied 50% to its recent peak in late January. Since then, risk assets including equities and commodities have largely retraced their post-election gains. As of11 March 2025, the NASDAQ-100 sits around 3% below election levels, while Bitcoin remains at approximately 14% above election levels.

The current risk-off environment is driven by U.S. tariff uncertainty, rising geopolitical tensions, and increasing recession probabilities. Despite this, we believe digital asset allocators should not be concerned, for the following reasons:

- Non-Crypto-Specific Selloff: This selloff is macro-induced due to rising recession fears, with no indication of crypto-specific risks. The recent Bybit hack, the only crypto risk event, was resolved and backstopped immediately with no contagion risk.

- FIFO Nature of Crypto: Bitcoin and crypto are often sold first during stress events but tend to recover swiftly when the dust settles.

- Deleveraged Crypto Market: Most leverage has been unwound, reducing the risk of a downward spiral.

- Geopolitical Disconnect: Since the root cause of the downturn is geopolitical, crypto’s borderless nature should fundamentally be more attractive in the long-term, not less.

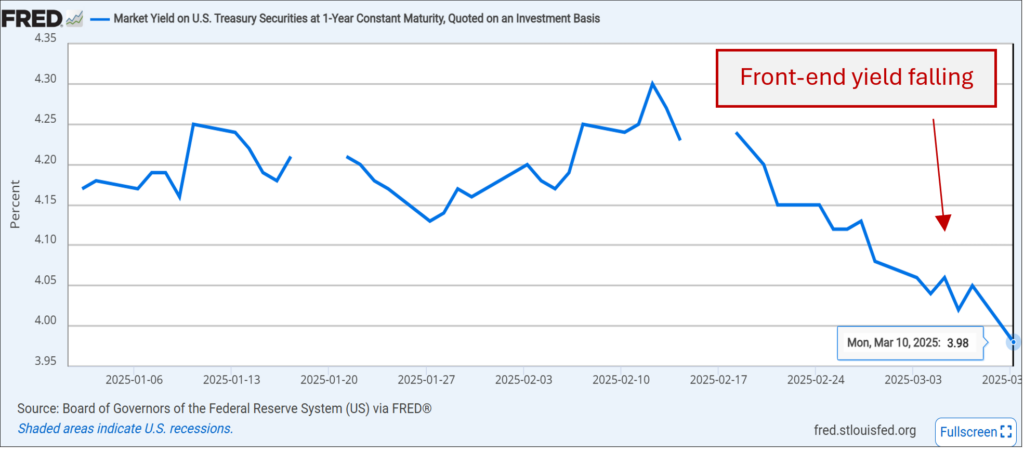

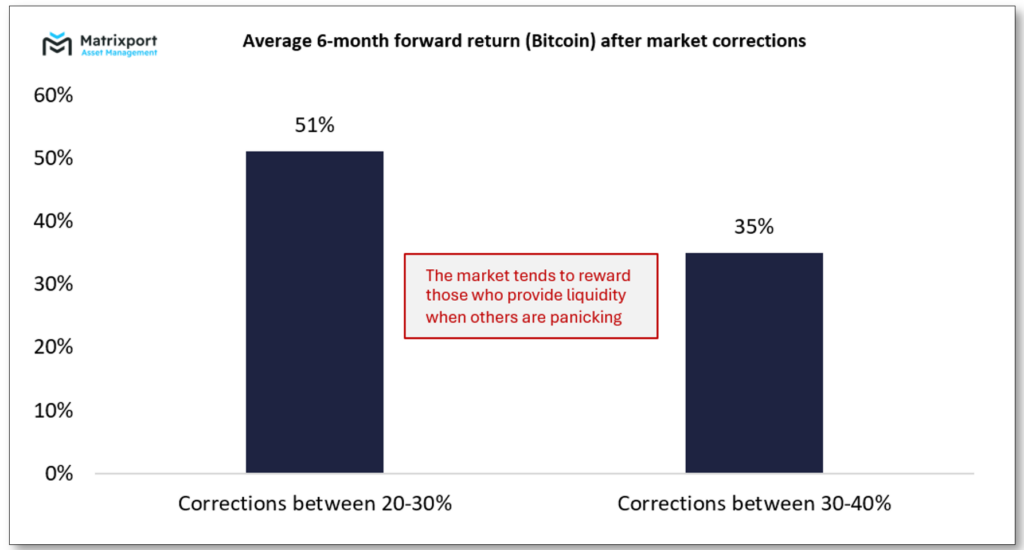

- Strategic Opportunity: The absence of fundamental crypto-specific issues makes this an opportune time to tactically build exposures. Especially during a time where short yields are falling (due to recession risks), we expect crypto to rally once the dust settles.

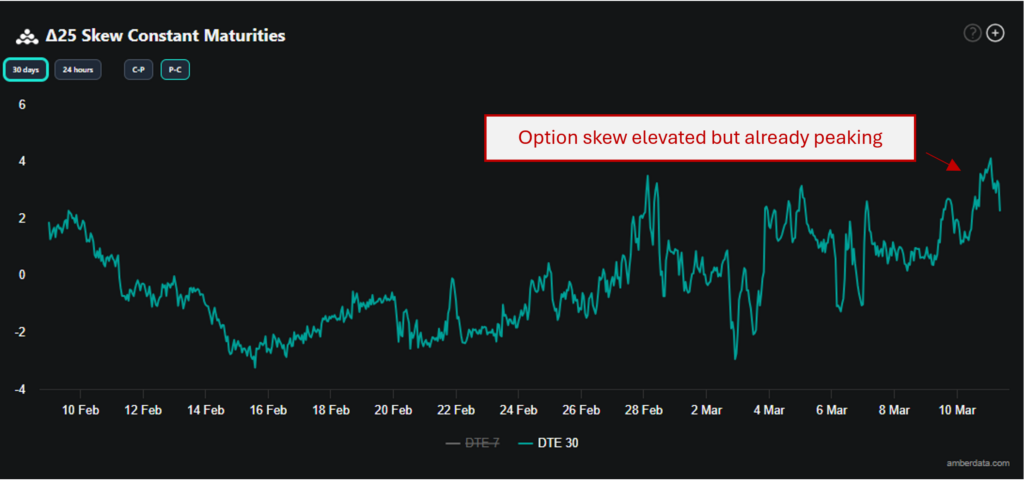

Put-call skew associated with positive future returns

Skew has recently widened as investors favored puts over calls. Typically, an elevated put-call skew is a result of stress being priced into the market, and such periods are often followed by positive future returns. In fact, in our proprietary research we found a positive and significant relationship between option-implied skew and future returns.

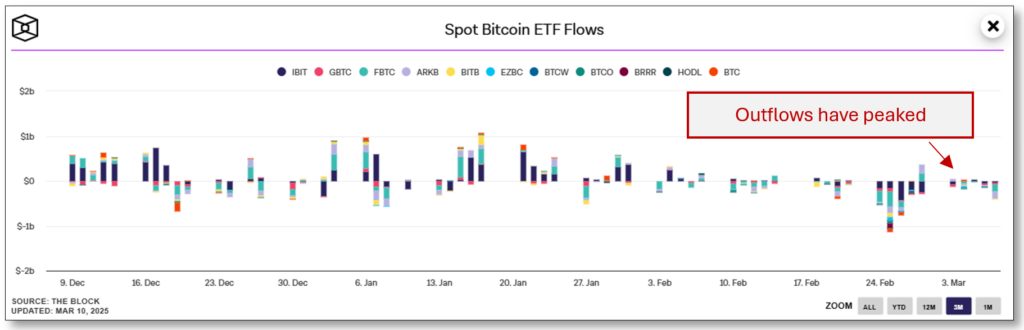

Little sign of ongoing selling pressure

The recent reversal in sentiment has caused Bitcoin ETFs to experience significant outflows. This was however only partially driven by net exits from Bitcoin, and rather an exit by hedge funds employing basis trades (buying the ETF and selling CME futures against it to capture what we call a “leverage premium”). These outflows have slowed since, with little sign of ongoing selling pressure.

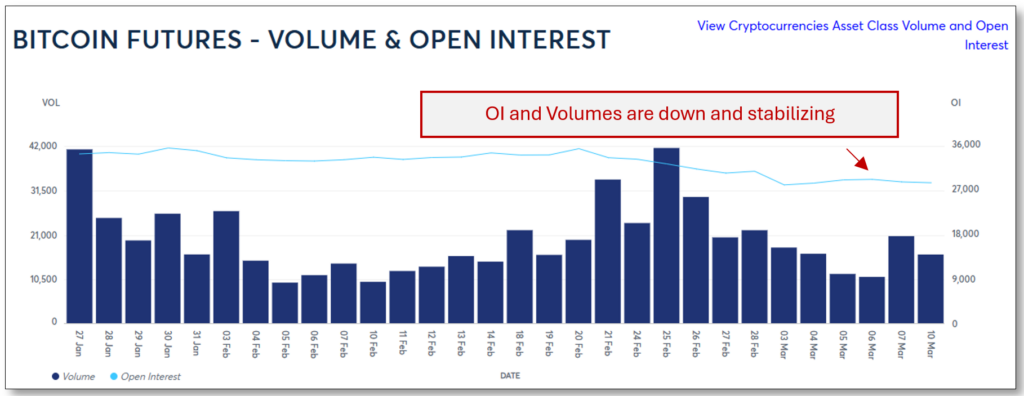

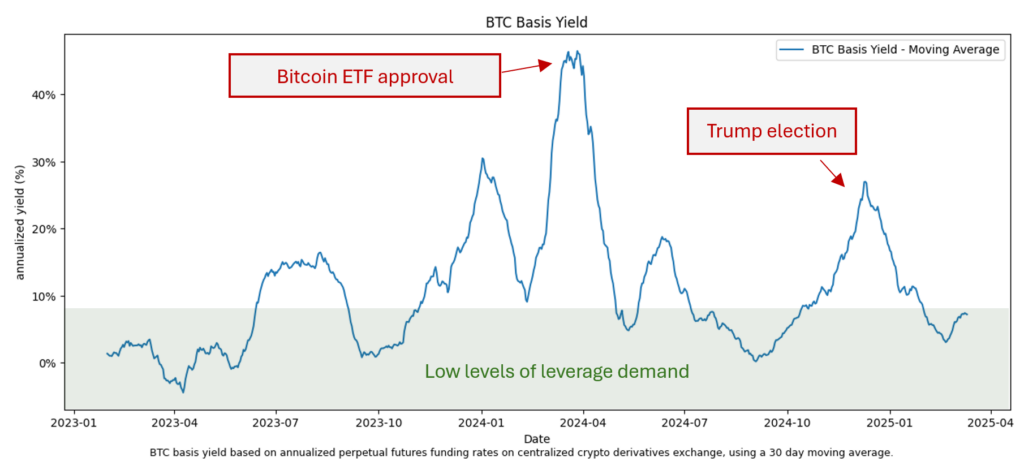

No significant risk of system-wide leverage

We also don’t see significant risk from system-wide leverage. Open interest & volumes across venues (chart from CME) has dropped materially and seem to stabilize. Additionally, the annualized futures basis, which is a proxy for leverage in the system has collapsed to historically low levels. This is a strong indication that the deleveraging is behind us.

We are optimistic about directional risk

Given this backdrop, we are optimistic about directional risk. We continue to monitor any impact on our product suite and trading activity. Please do not hesitate to contact us if you would like to discuss the current state of the market.

For questions or inquries, do not hesitate to contact us at:

info@matrixportam.com

+41 44 521 23 83

https://matrixportam.com/

Best regards,

The Matrixport Asset Management Team